📊 The Ultimate Guide to Stock Market Investing in India (2025)

|

| Guide to Stock Market Investing India - 2025 |

🌟 Introduction

Stock market investing has long been seen as a gateway to wealth creation and financial freedom. In 2025, with India's economy booming, technology evolving, and youth participation rising, the stock market is no longer a playground only for the elite. This blog is your 100% practical and simplified guide to starting, understanding, and mastering stock market investing in India.

Whether you are a beginner, a student, or someone looking to grow your money beyond fixed deposits and mutual funds, this guide will empower you with real-world strategies, tools, and stock-specific insights.

💸 Why Invest in the Stock Market?

1. High Returns Potential: Over the long term, the stock market has outperformed most other forms of investment, including gold and real estate.

2. Ownership in Businesses: By buying a share, you're owning a piece of a company like Reliance, TCS, or Zomato.

3. Dividend Income: Many companies pay regular dividends to shareholders.

4. Compounding Effect: Reinvesting earnings creates exponential growth.

5. Liquidity: You can buy/sell shares almost instantly during market hours.

🤔 Who Should Invest in the Stock Market?

Anyone with:

-

A basic understanding of risk and reward

-

A desire to grow wealth over 3–5 years or longer

-

The discipline to stay invested during market ups and downs

Suitable For:

-

Salaried professionals

Students

-

Small business owners

-

Retired individuals looking for passive income

🧰 Types of Stocks in India

✅ Large Cap

Features: Stable, low-risk, good for long-term holding

✅ Mid Cap

Features: Higher growth, slightly higher risk

✅ Small Cap

Features: High growth potential, high risk, high volatility

✅ Penny Stocks

Features: Extremely volatile; only for experts

Examples: Reliance Industries, Infosys, HDFC Bank

Examples: Tata Elxsi, Balkrishna Industries

Examples: Suzlon Energy, Ujjivan Small Finance Bank

Very low-priced stocks (<₹100)

🔢 Beginner's Checklist Before Investing

-

PAN Card

-

Bank Account

-

Demat & Trading Account (Zerodha, Groww, Upstox)

-

Basic Market Knowledge

-

Risk Appetite Assessment

-

Emergency Fund (3–6 months)

📊 Long-Term vs Short-Term Investing

| Strategy | Horizon | Risk Level | Return Potential |

|---|---|---|---|

| Long-Term | 3–10 years | Moderate | High |

| Short-Term | < 1 year | High | Moderate to High |

| Intraday/Trading | Within a day | Very High | Risky |

Tip: For most investors, long-term investing in strong fundamental stocks is the safest way.

📊 Fundamental vs Technical Analysis

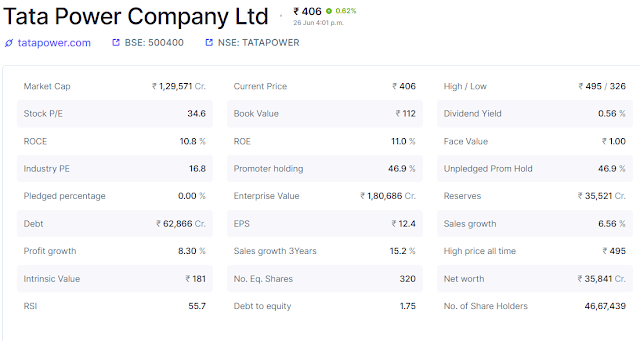

📊 Fundamental Analysis

-

Company Financials (Revenue, Profit, Debt)

-

Management Quality

-

Industry Position

-

P/E Ratio, ROE, EPS

🔄 Technical Analysis

-

Charts & Indicators

-

Support & Resistance

-

Moving Averages

-

RSI, MACD, Bollinger Bands

Tip: Long-term investors should focus on fundamentals. Traders use technicals.

🌍 Top Stock Sectors to Watch in 2025

-

Green Energy (Tata Power, Waaree, Suzlon)

-

Banking & Finance (HDFC, ICICI, SBI)

-

EV and Auto (Tata Motors, Mahindra, Sona BLW)

-

Pharma & Healthcare (Sun Pharma, Lupin)

-

IT Services (TCS, Infosys, LTIMindtree)

-

Infra & Rail (IRCTC, RITES, RVNL)

-

FMCG (HUL, ITC, Nestle India)

🚀 Powerful Strategies to Maximize Stock Market Gains

1. SIP in Stocks

Invest fixed amounts monthly in strong companies.

2. Value Investing

Buy undervalued stocks and hold long-term.

3. Thematic Investing

Focus on sectors (e.g., green energy, EVs)

4. Buy on Dips

Invest more during market correction.

5. Avoid Herd Mentality

Do your own research; don’t blindly follow news or social media.

🌎 Top Platforms for Beginners

-

Zerodha (low brokerage, great charts)

-

Groww (easy UI)

-

Upstox (fast and intuitive)

-

Angel One (smart recommendations)

🔎 Risk Management Tips

-

Never invest money you can't afford to lose

-

Diversify across 5–7 sectors

-

Use stop-loss while trading

-

Regularly review your portfolio

-

Don’t invest based on hype

👀 Red Flags in Stocks to Avoid

-

Sudden price spikes without reason

-

Companies with high debt

-

Negative news coverage

-

Low promoter holding

🔮 Tools & Resources for Indian Investors

-

Screener.in (for stock analysis)

-

Moneycontrol, ET Markets (news)

-

Tickertape, Trendlyne (ratios & screening)

-

Investing.com, TradingView (charts)

🤝 Common Mistakes to Avoid

-

Buying only cheap stocks

-

Not booking profits

-

Overtrading and panic selling

-

Ignoring asset allocation

-

Holding onto losses hoping for recovery

📣 Final Words: Stock Market is a Marathon, Not a Sprint

Wealth is not created overnight. With discipline, patience, research, and regular investing, you can build long-term financial freedom. Don't wait for the "right time" to invest. Start small, stay consistent, and grow your knowledge every day.

🎉 BONUS: Free Monthly Stock Picks Newsletter

Subscribe to our tech1baba.blogspot.com blog and get:

-

Top 3 stock picks every month

-

Sector analysis

-

Entry & exit suggestions

-

Early alerts on IPOs & earnings

[Subscribe Now]

Also read : Power Sector Best Stocks|Tata Power|Suzlon Energy|Waaree Energies| Future Review(2025 to 2030)

Also read : Suzlon Energy Price | Prediction target 2023, 2024, 2025, 2026, 2027 ....

Also read : Stock market basic

Also read : Suzlon Energy Stock | Future of Suzlon Energy

📊 Disclaimer: This content is for educational purposes only. Please consult a SEBI-registered advisor before investing.

Written by: Team tech1baba.blogspot.com