Today we discuss about SGX Nifty means about Singapore Exchange Limited

SGX Nifty, also known as Singapore Nifty and it is a futures contract based on the National Stock Exchange of India's (NSE) Nifty 50 Index, which is the benchmark stock index of India. SGX Nifty allows investors to trade Nifty futures contracts even when the NSE is closed due to time zone differences between India and Singapore.

Here, we know how SGX Nifty different from Indian Nifty 50 index :

- SGX Nifty is a futures contract which is traded in Singapore, whereas the Indian Nifty index trades only on the Indian stock exchange which is the National Stock Exchange (NSE).

- Another important factor is the contract size of the Indian Nifty index and the SGX nifty futures in lot sizes. In Indian Nifty contract the lot size is 50, but in SGX Nifty lot size not required.

- SGX Nifty sees a high volume and trading because it is the most active trading platform in Singapore Exchange and the only trading platform that works for sixteen hours a day outside the Indian Stock Exchange.

- Above features of SGX Nifty makes it more profitable as compare to Indian Nifty Index.

Here, we know how SGX Nifty impact the Indian Stock Market :

- As we discussed above about time zone of SGX Nifty or SGX Nifty Futures is differ as comparison to India Nifty Index. In this happening SGX Nifty Live in Singapore market about 2.5 hours before the Indian Stock Market.

- SGX Nifty or SGX Nifty Futures trading in Singapore Stock Exchange trading platform that works for 16 hours a day. This makes SGX Nifty very helpful in predicting the Indian Nifty Index before market open in Indian Stock Exchange.

- SGX Nifty gives power to investors to know the fluctuations in the Indian Stock Market Nifty Indexes which will start in India. You may also call SGX Nifty as mirror of Indian Stock Exchange.

- By checking SGX Nifty Live status from Singapore Exchange (SGX) investor/trader from Indian stock market can get idea about the Indian market that whether it will open with positive or negative results.

- In every morning i.e. 08.30 am as per Indian time zone SGX Nifty Live in Singapore Exchange (SGX) which gives investor/traders a sense that how Indian Stock Market would open today.

Here, we know about benefits of SGX Nifty :

- Encourages more foreign investors to invest in the Indian derivative market.

- The proximity in location between India and Singapore ensures that there is better connectivity between the two exchanges and lesser time lapse.

- It provides a good alternative to investors who do not have access to Indian markets especially if they seek to transact in terms of US Dollars.

- 24-Hour Trading: SGX Nifty trading is available for 16 hours every weekday, offering investors an extended trading window.

- Hedging: SGX Nifty provides an opportunity for investors to hedge their exposure to the Indian market. They can use the SGX Nifty to take positions based on their view of the market, without actually having to invest in Indian stocks.

- Access to Foreign Investors: The SGX Nifty allows foreign investors to participate in the Indian stock market without the need for a local presence, which can be difficult and costly.

- Liquidity: SGX Nifty futures are highly liquid, with a daily average trading volume of several billion dollars. This high liquidity provides investors with better price discovery and the ability to enter or exit positions quickly.

- Low Transaction Costs: Trading SGX Nifty futures incurs lower transaction costs compared to investing directly in the Indian stock market, making it an attractive option for traders and investors.

- Diversification: SGX Nifty allows investors to diversify their portfolios by providing exposure to a range of sectors in the Indian economy.

- Overall, SGX Nifty offers investors a convenient and cost-effective way to access the Indian stock market and hedge their exposure to the Indian economy.

Here, we know about disadvantage of SGX Nifty :

- Regulatory Issues: The use of SGX Nifty has been a source of contention between Indian and Singaporean regulators, with India's Securities and Exchange Board of India (SEBI) expressing concerns over potential market fragmentation and unfair trading practices. This has led to regulatory changes that have impacted the availability and trading volumes of SGX Nifty futures.

- Currency Risk: SGX Nifty futures are traded in Singapore dollars, which means that investors are exposed to currency risk if they have to convert their investments back into their home currency.

- Limited Market Hours: While SGX Nifty offers extended trading hours, it still has limitations as it operates only during Singapore trading hours, which means it may not reflect the current market conditions in India during the Indian trading hours.

- Limited Exposure to Individual Stocks: SGX Nifty is based on the Nifty 50 index, which is composed of only 50 of the largest and most actively traded stocks on the National Stock Exchange of India. This means that investors are limited in their exposure to individual stocks and may not be able to capture the full spectrum of the Indian market.

- Overall, while SGX Nifty offers several benefits, investors should consider the potential disadvantages and risks associated with trading SGX Nifty futures, including regulatory issues, currency risk, limited market hours, and limited exposure to individual stocks.

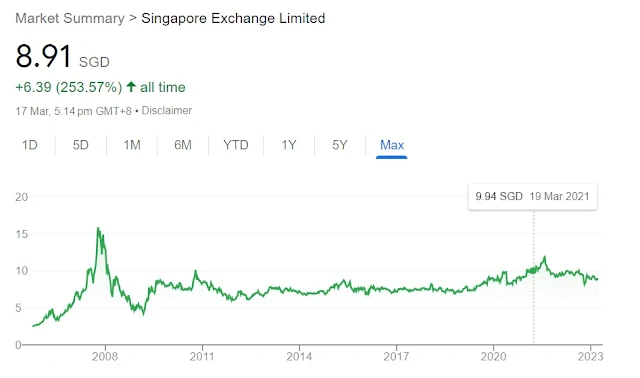

Now, Let's see the all time chart of SGX Nifty or SGX Nifty Futures :

Before investing in SGX Nifty of SGX Nifty Futures some suggestion is given below :

- Do your research: Before investing in SGX Nifty, do your research on the Indian market, the Nifty 50 index, and the factors that can impact the index's performances.

- Use SGX Nifty as a hedging tool: Consider using SGX Nifty futures as a hedging tool to manage your exposure to the Indian market.

- Monitor currency risk: Be aware of the currency risk associated with investing in SGX Nifty, and consider ways to mitigate this risk, such as using currency hedging strategies.

- Consider other investment options: While SGX Nifty offers a convenient way to access the Indian market, consider other investment options, such as investing directly in Indian stocks or using exchange-traded funds (ETFs) that track the Indian market.

- Follow market news and events: Stay up-to-date on market news and events that can impact the Indian market and the Nifty 50 index's performance.

- Consult with a financial advisor: Consider consulting with a financial advisor who has expertise in investing in the Indian market and can help you develop a sound investment strategy that is tailored to your specific needs and goals.

No comments:

Post a Comment